A1: Both the state (Fla. Stat. Sec 1010.25) and federal governments (HEA, Section 117) define four types of Foreign Sources:

- A foreign government, including an agency of a foreign government

- Examples of foreign governments include France and the People’s Republic of China.

- Examples of agencies of a foreign government include the Royal Embassy of Saudi Arabia, Higher Education Commission of Pakistan, or Ministry of Environmental Protection of Israel.

- A legal entity, created solely under the laws of a foreign state or states;

- Examples include business like AstraZeneca (headquartered in Cambridge, England), Hortifrut (headquartered in Chile), or Koninklijke Philips N.V. (headquartered in the Netherlands) and universities like Peking University in Beijing.

- An individual who is not a citizen or a national of the United States or a trust territory or protectorate thereof; and

- An agent, including a subsidiary or affiliate of a foreign legal entity, acting on behalf of a Foreign Source.

- Examples of agents include clinical research organizations (CROs), like IQVIA (headquartered in Durham, North Carolina), which may oversee sponsored research on behalf of a foreign pharmaceutical company, like Bayer Aktiengesellschaft (a German corporation).

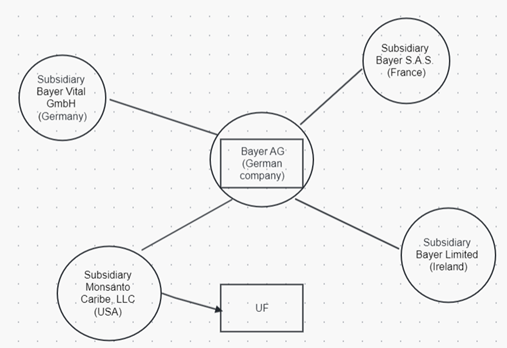

- Examples of subsidiaries of a foreign legal entity include Monsanto Technology, LLC. (a U.S. corporation), which is a subsidiary of Bayer Aktiengesellschaft (a German Corporation).

A2: Yes, there are at least three situations where this can happen.

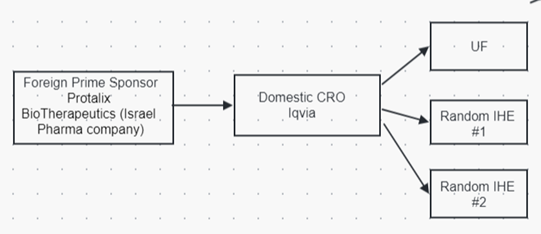

- First, U.S. citizens and corporations are regarded as Foreign Sources when they act as agents on behalf of a foreign government, legal entity, or citizen. For example, in the graphic below, when IQVIA, a U.S. clinical research organization (CRO), manages a research study for the Israeli pharmaceutical company, Protalix BioTherapeutics, IQVIA serves as Protalix’s agent. Therefore, IQVIA is a Foreign Source for this study.

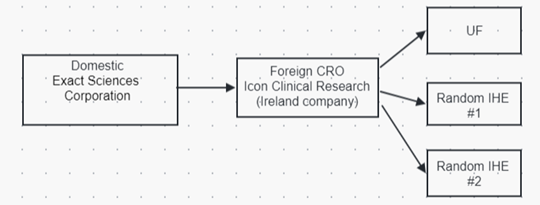

- Second, funds originally from U.S. sources are reportable FGC transactions if they flow into UF via a foreign government, foreign legal entity, or foreign citizen. For example, in the graphic below, Exact Sciences Corporation, a U.S. corporation hires a Irish CRO to run its research program, which includes paying researchers like UF. Because the funds flow to UF through a foreign legal entity, the transaction is reportable, even though the funds are originally coming from a U.S. source.

- Third, U.S.-based subsidiaries or affiliates of foreign legal entities are designated as Foreign Sources. Example (Graphic 3), Bayer AG is a German company with subsidiaries throughout the world, including Monsanto Caribe, LLC (Monsanto), based in St. Louis, Missouri. If a reporting unit enters into a research contract with Monsanto, Monsanto is designated as a Foreign Source because it is a subsidiary of Bayer AG.

A3: Yes. Foreign subsidiaries of U.S.-based corporations may constitute Foreign Sources by virtue of their satisfying the definition of a foreign legal entity (see 20 U.S.C. § 1011f(h)(2)(B)).

A4: The U.S. Department of Education (ED) requires institutions to perform due diligence and “make a good faith effort” to determine whether a gift or contract involves an agent, subsidiary, or affiliate acting on behalf of a foreign source. According to recent ED guidance, certification from a donor or contract partner that it is not acting as an agent or affiliate of a Foreign Source can be part of an institution of higher education’s efforts but increased due diligence (including collecting additional information about or from the donor or contract partner) might also be required. For example, ED notes that additional due diligence efforts may be required the first time an institution enters into a large transaction with a partner or sponsor not well known to it. Future transactions with the same entity or routine transactions of smaller amounts may require less due diligence.

A5: No. An individual who has dual citizenship that includes United States citizenship is not considered a Foreign Source.

2. What type of transactions are reported to UFCE by reporting units?

Reminder: Reporting units report any potentially reportable transactions to UF Compliance and Ethics (UFCE), not directly to the federal or state government. UFCE, in turn, collates all the reported transactions and reports the required information to the federal and state governments.

A6: Reporting units need to report three main types of transactions to UFCE, namely:

- Gifts received from any Foreign Source that were not processed by the University of Florida Foundation – this includes any pledges, monetary gifts or gifts-in-kind FLOWING INTO the reporting unit.

- Contracts entered into with any Foreign Source that were not processed by the Division of Sponsored Programs, UF Innovate, or the Bursar – this includes any transaction with a Foreign Source (written or otherwise) through which money or in-kind services FLOW INTO the reporting unit.

- Purchases, leases, or barters of property or services the unit made from any statutorily designated Foreign Country of Concern (i.e., China, Russia, Iran, North Korea, Cuba, Venezuela, and Syria that were not purchased through myUF Marketplace. Include any transactions from these Foreign Country of Concern’s agencies or any other entities under the country’s significant control. [This represents money FLOWING OUT of the reporting units into these specific governments and governmental agencies].

A7: The following sources of funds are not reportable:

- Foreign income on investments

- Payments for patient care (patient self-pay or foreign insurance companies)

- Note: Payments from foreign insurance companies unrelated to direct patient care are reportable (e.g., payments to depose a physician to discuss the patient’s care pursuant to a lawsuit)

- Dividends from Foreign Sources

- Rebates from Foreign Sources

- Refunds returned to Foreign Source

- Example: Foreign Source utility company pays for four of its employees to attend a conference at UF, but only three of their employees attend. UF refunds all (or some) of the registration fees back to the Foreign Source utility company. The amount that should be reported to UFCE is the initial payment for four employees; UFCE does not need to be informed of any refunds returned to the Foreign Source utility company.

A8: Such subcontracts must be reported unless all three of the following conditions are met:

- UF and the U.S. entity are the only parties to the subcontract.

- UF is providing services directly to the U.S. entity to allow the US entity to fulfill its responsibilities under its contract with the Foreign Source.

- UF’s sold responsibilities under the subcontract are to the U.S. entity; UF has no responsibilities to the Foreign Source.

- Example: A Foreign Source enters into a research agreement with a U.S. university. However, UF has more expertise on one small question under investigation, so the U.S. university enters into a subcontract with UF to investigate that one small question. The results will be given directly to the U.S. university. UF has no role in the main research agreement. This subcontract does not need to be reported.

A9: Only if you have knowledge that they are acting on behalf of a foreign entity (see Question Q2).

A10: No. The Foreign Gifts and Contract Reporting laws’ thresholds are based on the total value of gifts and contracts made to the entire university. The same Foreign Source may provide gifts or contracts to multiple units across the university and all such gifts and contracts must be aggregated together for the purpose of determining if they meet the threshold. To ensure accurate reporting, UFCE must receive information regarding all foreign gifts and contracts regardless of the amount. UFCE will aggregate transactions from the same Foreign Source and identify which transactions are reportable.

- Example: a foreign corporation enters into a contract for $49,940 with one reporting unit and donates $70 to another reporting unit. Although, neither transaction meets the reporting threshold on its own, both transactions, when aggregated, meet the $50,000 threshold for reporting the transaction on the State report.

A11: Yes.

A12: No. For example, if a reporting unit holds a conference and charges Foreign Sources for housing during the conference, the reporting unit would not include in the reported transaction amount any tourist tax, resort tax, or bed tax paid by the university to a local, state, or federal governmental entity (even if this amount is paid by the Foreign Source to UF before UF pays it to the governmental entity).

A13: Yes.

A14: Reporting units should report to UFCE the amounts actually received as part of the transaction with the Foreign Source. If, because of the monetary exchange rate, more or less money was received then any agreement required, please provide a comment in the comment box to explain the difference. For example, if a reporting unit was supposed to receive $10,000 under a contract, but after payment the exchange rate reduced the amount actually received by the reporting unit to be $9,900, the reporting unit would provide a comment stating “$10,000 originally owed; because of exchange rate fluctuations, the amount actually received was $9,900.” If the unit wrote off the remaining $100, that should be noted as well.

A15: UFCE focuses on the country where the online vendor was formed. Reporting units must report purchases from online vendors formed under the laws of a Foreign Country of Concern (e.g., Alibaba and Ali Express, both of which are Chinese companies). Reporting units do not report purchases from online vendors formed in countries that are not Foreign Countries of Concern (e.g., Amazon and e-bay, both of which are U.S.-based companies), even if the products purchased through these vendors were manufactured in a Foreign Country of Concern.

A16a: See FGC User’s Guide.

A16b: See FGC User’s Guide.

A16b: See FGC User’s Guide.

A17: Report payments received during the reporting period. For the date, use the last day of the reporting period (i.e., 6/30/xx or 12/31/xx)

A18: Enter the full amount of the purchase and the date of payment.

A19: The state’s FGC reporting process requires documentation be submitted for each transaction reported. The type of documentation required depends on the type of transaction:

- If an agreement memorializes the foreign gift or contract, the reporting unit must provide UFCE with a copy of that agreement.

- If confidential or privileged information has been redacted from the agreement [see the next FAQ], the reporting unit must also submit to UFCE an abstract which includes a description of the redacted information and the reason for the redaction.

- If a reporting unit is submitting student sponsorship information (e.g., data about a country paying the university tuition and fees for X students from their country), the unit should provide UFCE with:

- A completed Student Sponsorship Summary Form and

- A sample sponsorship letter from the country.

- If there is no agreement memorializing the foreign gift or contract, the reporting unit must provide to UFCE a No Agreement Memo explaining that there is no formal agreement associated with the gift.

For more information on this topic, please see the FGC User’s Guide.

A20: UF can redact from agreements confidential and privileged information, but only to the extent allowed by federal or state laws. The state statutes listed below are the ones most used to provide authority to redact confidential or privileged information from a reported agreement. If used to redact any information for an agreement, the statute should be listed in the abstract submitted with the redacted agreement:

- 688.002 – Provides the definition of and protections for trade secrets. Often used to support redaction of licensing agreements.

- 812.081 – Provides the definition of and protections for trade secrets. Creates crimes regarding the misuse or misappropriate of trade secrets. Often used to support redaction of licensing agreements.

- 1004.22 – Creates divisions of sponsored research at state universities and allows for the protection of potential and actual trade secrets as well as other confidential and privileged information. Often used to support redaction of licensing agreements and DSP records.

- 1004.22(2) – Creates authority within universities to create policies and practices for state university DSPs that protect potential and actual trade secrets as well as other confidential and privileged information. Often used to support redaction of DSP records.

- 1004.28 – Allows universities to create of direct support organizations and to protect certain information from the public. Often used to support redaction of various DSO agreements (such as some contracts entered into by Florida Foundation Seed Producers, Inc.)

- 1006.52 – Protects student education records (offers the same protections that FERPA offers at the Federal level). Often used to redact any student records, including student sponsorship and/or scholarship records.

A21: If someone makes a public records request for the agreements submitted to the BOG as part of the state FGC process, the BOG will provide them. This means we will need to be as thorough as possible in our redaction.

A22: Both the federal law and the Board of Governor’s guidance on the state law define the term "restricted or conditional gift or contract" to mean any endowment, gift, grant, contract, award, present, or property of any kind which includes provisions regarding:

- The employment, assignment, or termination of faculty (for example, a requirement that Professor X work in a specific department within a specific college);

- The establishment of departments, centers, research or lecture programs, or new faculty positions (for example, the creation of or continued funding for a lecture program on a specific topic or within a specific college);

- The selection or admission of students (for example, a gift requirement that student X be admitted the university); or

- The award of grants, loans, scholarships, fellowships, or other forms of financial aid restricted to students of a specified country, religion, sex, ethnic origin, or political opinion (for example, a scholarship only available to students of a specific country).

A23: UF interprets this category of restricted gifts and contracts to not only include gifts or contracts that support new departments, centers, research, or lecture programs, but also those gifts or contracts that support existing departments, centers, research, or lecture programs. For example, a gift to support a medical school professor’s pre-existing cancer research should be treated as a restricted gift or contract. When providing a narrative description of the restriction, the reporting unit should list the department, center, research, or lecture program that the funds are supporting.